HMA Financials

Bestselling Course Offerings on Stock Market

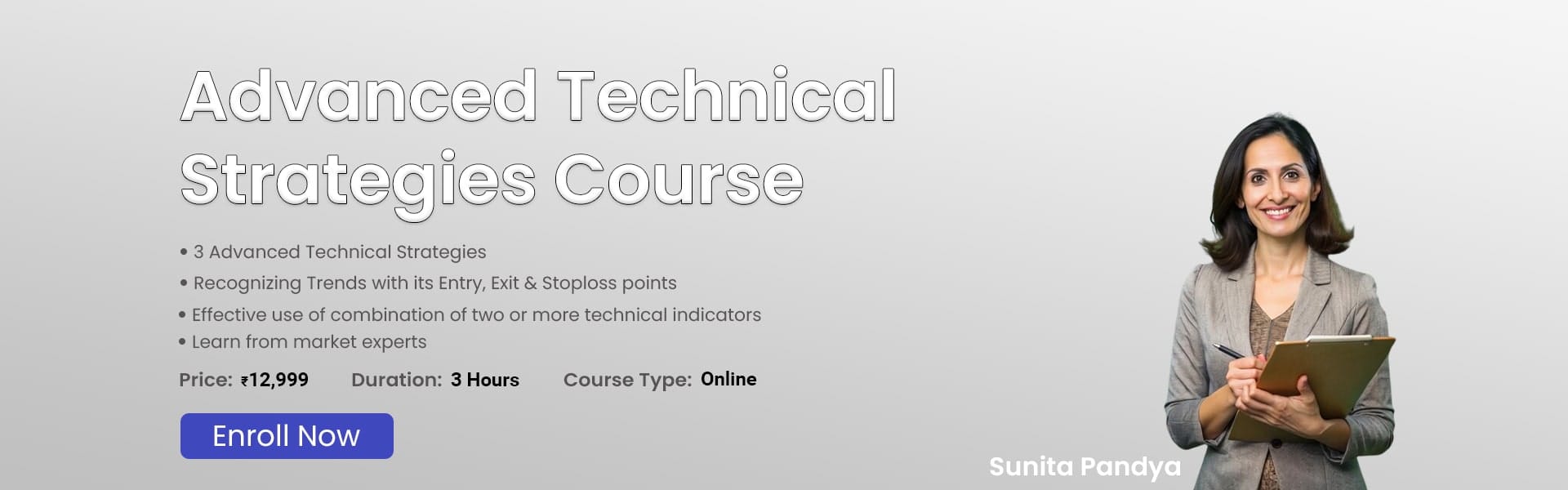

By Sunita Pandya

Advanced Technical Strategies

4.2

₹12,999

3 hours to complete

By Rajesh Thakur

Technical Analysis

4.5

₹7,999

3 hours to complete

Combining two or more technical indicators to create a powerful instrument for swing traders in the financial markets is known as an advanced technical strategy. It recognizes any trend at a very early stage of trend formation, allowing traders and investors to make well-informed judgments based on past price data and market trends. As a result, swing traders benefit from increased trading confidence and profitability.

The goal of this course is to give students a thorough understanding of trends with multiple technical analysis techniques and entry, exit, and stop loss points. This course is designed to satisfy the needs of both new and seasoned traders.

One useful instrument in the world of financial markets is technical analysis. By using past pricing data and market trends, it helps traders and investors to make well-informed judgments.

The goal of this course is to give students a thorough understanding of technical analysis concepts. It will offer comprehensive training modules covering the fundamentals of chart analysis, pattern identification, and the examination of various technical indicators. This course is designed to satisfy the needs of both new and seasoned traders.

Founding and Vision

26K

Total Learners

5+

Specialized Courses

100+

Strategy Webinars

Webinars for Stock Market Traders & Investors

By Sunita Pandya

Golden Cash Market Strategy using Price & Delivery

4.5

₹1,999

By Rajesh Thakur

Become a Blazing TENDULKAR with Relative Strength (RS)

4.2

₹1,499

By Ritu Verma

3 Powerful Use of RSI

4.7

₹1,599

By Vivek Singh

Trading Breakouts, Reversals And Ranges

4.9

₹1,199

Learn trading from Stock Market Superheroes

Sunita Pandya

10 Years of Experience

Rajesh Thakur

16 Years of Experience

Ritu Verma

15 Years of Experience

Vivek Singh

8 Years of Experience

Key Features and Methodology

Why people choose Courses

Ram Singh

I found the Technical Analysis Course to be highly informative and engaging. The real-life case studies and interactive sessions were a great addition.

Puja Yadav

The Advanced Technical Strategies Course is excellent for those looking to deepen their market analysis skills. The advanced strategies covered were comprehensive and practical.

Rakesh Kumar

Highly recommend this course for experienced traders. The in-depth analysis and advanced techniques provided valuable insights that improved my trading strategies.

Trust Building Community Empowerment Future Growth" focuses on establishing credibility through recognition, fostering a supportive community, and exploring new opportunities for continued success and innovation.

HMA Financials is renowned for its dedication to high-quality learning. Their courses have garnered great feedback from students and are accredited by multiple financial education authorities. The organization has established a solid reputation in the financial education industry thanks to its emphasis on practical knowledge and real-world trading skills.

A thriving community of traders has been established by HMA Financials, who actively share and provide assistance to one another. A fundamental component of the company's ethos, the community feature gives traders a platform to exchange ideas, discuss tactics, and work together on market analysis.

In the future, HMA Financials wants to investigate new topics in financial education, like artificial intelligence in trading and sustainable investing, and broaden the range of courses it offers. By regularly revising its curriculum to incorporate the newest technological advancements and market trends, they are dedicated to remaining at the forefront of financial education.

Why you choose HMA Finance

HMA Financials is a pioneer in the field of financial education, providing a comprehensive approach to trading that blends academic understanding with real-world implementation. They are an invaluable resource for anyone hoping to succeed in the financial markets because of their extensive curriculum, knowledgeable professors, and encouraging community. HMA Financials offers the resources and training required for success, regardless of your level of experience. Whether you're a beginner looking to get started in trading or an expert hoping to improve your skills.